Bitcoin Plunges Below $60,000 Amid Mt. Gox Repayment Fears: What’s Next for BTC?

- Bitcoin (BTC) fell by 3.04% to $60,216 on July 3, driven by fears surrounding the impending Mt. Gox repayment to creditors.

- Investor sentiment was further influenced by weak US labor market data, which heightened expectations of a September Fed rate cut but failed to spur a BTC rally.

Bitcoin (BTC) saw a significant drop on Wednesday, July 3, falling by 3.04% to close at $60,216. This decline followed a 1.25% loss on Tuesday, July 2, and was largely driven by market jitters surrounding the impending Mt. Gox repayment to its creditors, a factor that continues to impact the broader cryptocurrency market.

The Mt. Gox Effect

Mt. Gox, once the world’s largest bitcoin exchange, collapsed in 2014 after a massive hack resulted in the loss of 850,000 BTC. Now, over nine years later, the exchange is set to return approximately 141,000 BTC (worth around $8.5 billion at current prices) to its creditors. This impending release has created significant concern among investors, as many anticipate that creditors will sell their BTC, leading to increased supply and downward pressure on prices.

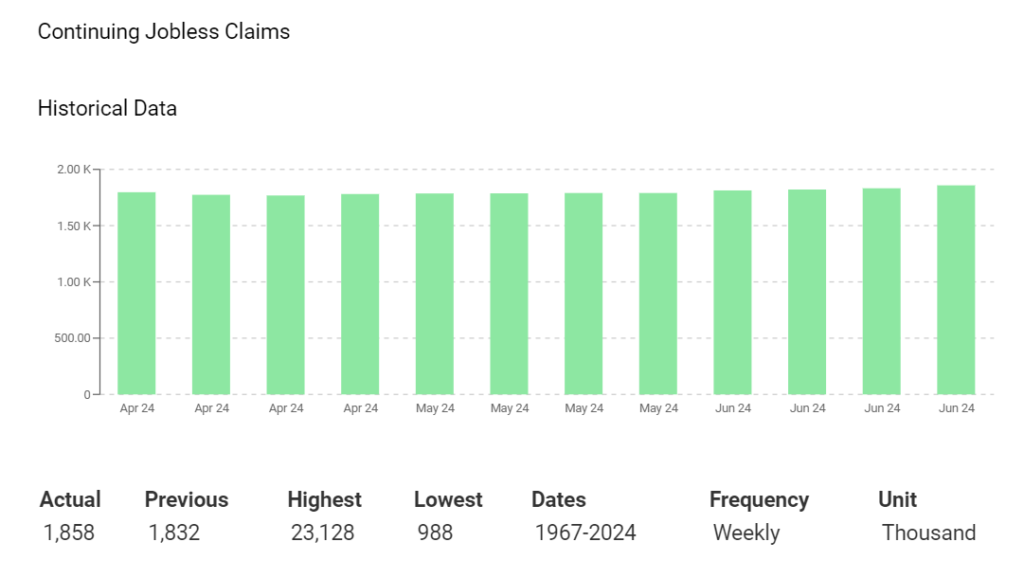

Adding to the market’s volatility, recent US economic indicators have influenced investor expectations regarding the Federal Reserve’s monetary policy. On Wednesday, the release of continuing jobless claims and weaker-than-expected ADP employment numbers signaled a weakening labor market, which increased bets on a potential September Fed rate cut.

Continuing jobless claims rose to 1,858,000 for the week ending June 22, the highest level since November 2021. The ADP report showed a modest increase of 150,000 jobs in June, falling short of the anticipated 160,000. These figures prompted investors to reassess the likelihood of the Fed holding interest rates steady, with the CME FedWatch Tool indicating a drop in the probability of unchanged rates from 31.2% to 26.5%.

Despite the favorable sentiment towards a rate cut, the fear of a substantial influx of BTC from the Mt. Gox repayment overshadowed these economic indicators, preventing a rally in the BTC market.

Impact on BTC and ETH ETFs

The US BTC-spot ETF market reflected this apprehension, experiencing net outflows for a second consecutive day. On Tuesday, July 2, the market saw net outflows of $13.7 million, ending a five-day inflow streak. This trend continued on Wednesday, with total net outflows amounting to $20.5 million, excluding data from the iShares Bitcoin Trust (IBIT).

Grayscale Bitcoin Trust (GBTC) recorded net outflows of $27.0 million, while Fidelity Wise Origin Bitcoin Fund (FBTC) reported net inflows of $6.5 million. These fluctuations underscore the cautious sentiment prevalent among investors amid the Mt. Gox repayment uncertainty and shifting expectations regarding the Fed’s rate path.

Technical Analysis

From a technical standpoint, Bitcoin remains below the 50-day EMA but above the 200-day EMA, indicating bearish near-term signals but bullish longer-term prospects. A move through the $64,000 resistance level could challenge the 50-day EMA, potentially paving the way to $69,000. Conversely, a drop below the $60,365 support level could see BTC testing the 200-day EMA.

Ethereum (ETH) also mirrors this trend, with prices below the 50-day EMA yet above the 200-day EMA. Breaking above the $3,480 resistance could signal a move towards $3,600, though a drop below $3,244 might push ETH to the 200-day EMA and beyond.

Conclusion

Investors should remain vigilant, tracking news on the Mt. Gox repayments, US economic data, and Fed rate path developments. Staying informed is crucial for navigating the volatile crypto market effectively.