Bitcoin Leads Crypto Crash: BTC, ETH, SOL, XRP, and SHIB Tumble Amidst Market Correction

- The crypto market experienced a sharp correction this week, with Bitcoin leading the decline due to options expiry, historical halving patterns, and macroeconomic factors

- The selloff resulted in a global market capitalization drop of over 8% and liquidations exceeding $950 million, but some analysts remain optimistic for the long term.pen_sparktunesharemore_vert

The cryptocurrency market experienced a significant downturn this week, with the global market capitalization plunging over 8% to a low of $2.38 trillion. This selloff resulted in a loss exceeding $250 billion in market value.

Bitcoin Triggers Market Selloff

Bitcoin, the leading cryptocurrency, bore the brunt of the selloff, with its price dropping from $70,978 to $65,254. Several factors contributed to this decline, including options expiry, historical Bitcoin halving patterns, macroeconomic factors, and technical vulnerabilities. Bitcoin’s fall triggered a domino effect, dragging down other major cryptocurrencies. Ethereum, the second-largest cryptocurrency, witnessed a 12% plunge, while altcoins like Solana (SOL), XRP (XRP), Cardano (ADA), Dogecoin (DOGE), and Shiba Inu (SHIB) plummeted by 15-30%. Meme coins, known for their volatility, were among the most heavily liquidated cryptocurrencies during this period.

Also Read: Bitcoin Miners Look Beyond Halving: Network Fees and Price Key to Profitability

Options Expiry Ignites the Selloff

The crypto market exhibited signs of weakness leading up to the release of U.S. CPI data earlier this week. Bitcoin’s rise to $72,000 was attributed to a range-bound movement fueled by rising Bitcoin ETF inflows and demand for long positions due to fear of missing out (FOMO) surrounding the upcoming Bitcoin halving event. However, experts like Benjamin Cowen, Peter Brandt, and Arthur Hayes predicted a potential market crash if Bitcoin mimicked price patterns observed during previous halving cycles and the recent listing of spot Bitcoin ETFs. Cowen specifically anticipated a drop below $60,000 for Bitcoin after the halving.

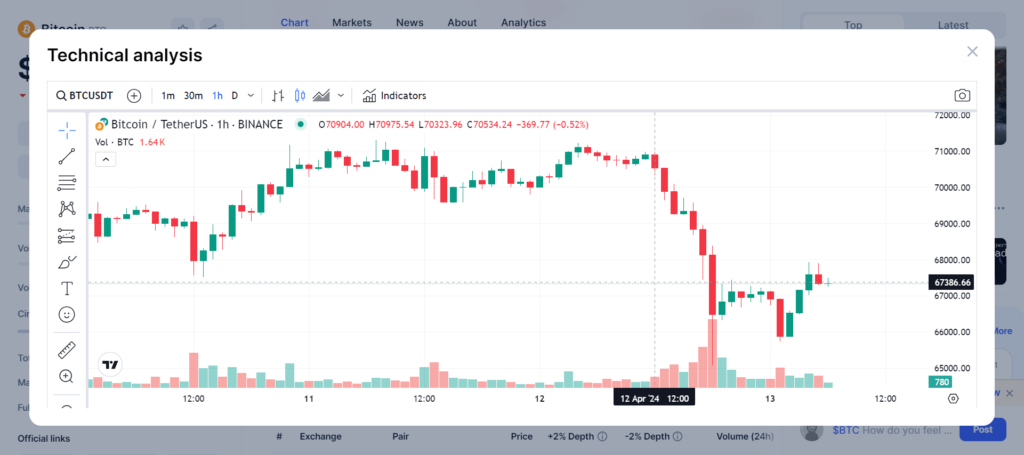

CoinGape, a cryptocurrency news platform, also forecasted a decline in Bitcoin (BTC) and Ethereum (ETH) prices following options expiry. The selloff began precisely at 12 PM UTC, coinciding with options expiry, as highlighted in the included chart. The reasons cited included lower max pain points compared to trading prices, a dominance of sell trades in the derivatives market with low volumes, and a dampened sentiment following the release of a hotter-than-expected CPI report.

Macroeconomic Factors Intensify the Downturn

Bitcoin’s price plunged further due to a combination of geopolitical tensions in the Middle East and negative market sentiment following major bank earnings reports. Notably, JPMorgan Chase shares witnessed a 6.47% drop on Friday. These global macroeconomic events caused the U.S. dollar index (DXY) to surpass 106, reaching its highest level since early November. Additionally, the U.S. 10-year Treasury yield surged to a 6-month high of 4.585%. Since Bitcoin’s price generally moves in the opposite direction of the DXY and Treasury yields, the rise in both factors contributed to the decline in Bitcoin’s price to $65,000, triggering a broader crypto market crash.

Is the Correction Over?

Data from Coinglass reveals that over $950 million were liquidated across the crypto market during this intense correction. Of this, $830 million were long positions, while short positions accounted for nearly $120 million in liquidations over the past 24 hours. Over 297,000 traders were liquidated, with the largest single liquidation order occurring on the crypto exchange OKX, where a user swapped ETH to USD for a staggering $7.19 million.

While QCP Capital maintains a structurally bullish outlook, they acknowledge that deleveraging dips, particularly following such a significant bull run this year, could extend further. They advise traders seeking to hedge against short-term downsides to consider the Bitcoin price at the May 31st expiry. Furthermore, Markus Thielen, CEO of 10x Research, suggests that Bitcoin miners could potentially sell $5 billion worth of Bitcoin after the halving event, with major investors leading the selloff.

As of this writing, Bitcoin is trading at $67,211 and remains under pressure. If the price fails to hold above support levels and cross above the 20-day simple moving average, the selloff might continue. Ethereum is currently priced at $3,252.