LINK Eyes New Highs: Real-World Asset Push and Technical Indicators Point Towards $24

- Chainlink (LINK) has experienced a substantial price surge, climbing to its highest point since January 2022.

- Positive social media buzz, increased trading activity, and involvement in the booming real-world asset tokenization market fuel investor optimism and suggest the potential for further price increases.

Chainlink (LINK) has emerged as a standout performer in the cryptocurrency market, experiencing a significant price surge and increased investor interest.

LINK’s Rise to Prominence:

Chainlink, a prominent player in the decentralized finance (DeFi) space, has been on an upward trajectory since the latter half of 2021. The company’s pivotal partnership with Swift and its established dominance in providing price feeds have solidified its position within the crypto industry.

Staking Pool Boosts Utility and Investor Confidence:

A crucial step taken by Chainlink last year was the launch of its staking pool. This initiative aimed to enhance the value proposition of the LINK token and instill long-term optimism among investors.

Tokenization of Real-World Assets: A Lucrative Opportunity:

Chainlink is actively involved in facilitating the tokenization of real-world assets, a market segment estimated to be worth trillions of dollars. Their unique position as a partner for major banks and companies venturing into this space positions them for significant future growth.

Chainlink Price Rallies:

- LINK’s price journey has been remarkable, transitioning from single-digit figures to reaching $21. This surge signifies a successful recovery from the recent bear market.

- On March 10th, a notable price increase of 8.45% propelled LINK to around $21.84, a price point last seen in January 2022.

- Bullish technical indicators, including an RSI below 63, suggest ample room for further price appreciation.

Social Sentiment and Trading Activity Align with Price Uptrend:

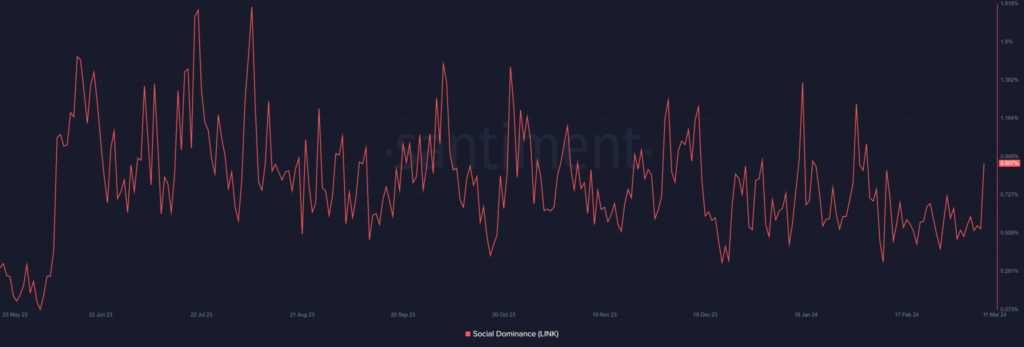

- Data from Santiment reveals a significant uptick in both social media mentions and trading volume for Chainlink, mirroring the positive price movement.

- Open interest data on Coinglass showcases a notable surge in recent weeks, indicating strong buying pressure and potential for continued price increases.

LINK Price Prediction:

- Having witnessed a price increase exceeding 200% within the past 147 days, LINK has established a strong foothold above the key resistance level of $17.75.

- With the price seemingly surpassing $19.7 on a sustained basis, further upward movement towards targets of $24 and $29 appears likely.

- A potential continuation of the rally could see $34.5 transform into a support level, paving the way for a new all-time high exceeding $50.

External Factors Influencing LINK’s Trajectory:

- Bitcoin’s price performance remains a crucial factor. Sustained Bitcoin prices above $70,000 could bolster the ongoing LINK rally.

Conclusion:

Chainlink’s recent price surge, coupled with positive social sentiment and strong trading activity, paints a promising picture for the token’s future. While external factors like Bitcoin’s price hold some influence, Chainlink’s involvement in the lucrative real-world asset tokenization space positions it for continued growth and potential price breakthroughs.